While the real estate industry is intimately involved with the mortgage industry, I do believe that sometimes we(or at least I) do not understand the way the mortgage industry works as much as I would like to. Furthermore, I didn’t understand (until I read this article) how individual real estate agents working together through their MLS can impact the valuation of bank property portfolios. Through this well-written article below from the RPR blog, I think it may help all of us understand why the RVM, RPR’s version of an AVM is working to help improve the overall value of the real estate industry which is good for every practitioner out there. Because of the improved accuracy the RVM brings over other AVM models using more dated and incomplete information to generate their estimates, RPR is helping to improve the quality of the metrics being used by banks and appraisers to value properties and property portfolios.

While the real estate industry is intimately involved with the mortgage industry, I do believe that sometimes we(or at least I) do not understand the way the mortgage industry works as much as I would like to. Furthermore, I didn’t understand (until I read this article) how individual real estate agents working together through their MLS can impact the valuation of bank property portfolios. Through this well-written article below from the RPR blog, I think it may help all of us understand why the RVM, RPR’s version of an AVM is working to help improve the overall value of the real estate industry which is good for every practitioner out there. Because of the improved accuracy the RVM brings over other AVM models using more dated and incomplete information to generate their estimates, RPR is helping to improve the quality of the metrics being used by banks and appraisers to value properties and property portfolios.

Enjoy the following….

What the REALTOR® and mortgage investor have in common – the importance of property analytics – what’s new and why it matters

Question: What do the REALTOR® and the mortgage investor have in common?

Answer: The need for the proper and accurate valuation of properties.

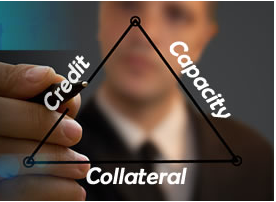

In this post, I will explain how RPR tools and features created for REALTORS® to use with their clients and customers also support the transaction within the mortgage industry. To better understand this relationship, let us start with the basics of mortgage credit risk: the 3 “C”s of underwriting:

Credit: Lenders examine a potential borrower’s credit history to determine their likeliness to repay debt.

Capacity: Lenders determine the stability of the consumer’s income, their debt-to-income ratio, and if they have adequate reserves.

Collateral: The determination of the loan-to-value ratio and the quality of the down payment (are funds borrowed? Seller-assisted gifts, etc.). This is also known as the borrower’s “skin in the game.” The lower the loan-to-value the less likely a borrower will walk away or default.

Key Points

When a mortgage loan fails to perform, mortgage investors rely on collateral value to recoup losses.

Collateral value comprises house price, condition and marketability.

An appraiser determines collateral value at a point in time. But with the large number of REO properties, short sales and refinances, automated valuation models (AVMs) and broker price opinions (BPOs) are being used to assist the mortgage lender and mortgage investor in benchmarking or supporting the assessed property value. AVMs are not new, but continued innovations by companies like RPR have made them more valuable to the mortgage industry. RPR’s Realtor Valuation Model® (RVM®), was created to assist the REALTOR® in developing pricing strategies with buyers and sellers who are increasingly relying on inaccurate third party AVM products to make their determinations of property values. RPR’s capabilities include the ability for a REALTOR® to make adjustments based upon current local market knowledge, and to generate reports for their clients and customers. This refined process by the REALTOR® to leverage the best of RVM with their subject property and local market data has some unique qualities that can also improve what the mortgage market uses in this space. In addition, a computer model cannot “see” a property, so the condition of the property may not be correctly accounted for in its determination of value. The RVM has the potential to “bridge” this information gap, giving both the consumer and the mortgage lender a more accurate and current automated valuation at the point of sale than any other third-party products provide. The RVM can basically help to unify the opinion of value set by the market (buyer and seller), and the value used to approve the loan.

Connecting the dots: the RVM, Appraisers and BPOs

While the RVM provides a more accurate AVM for REALTORS® to assist their clients and customers, it also creates analytics to support home value estimates. Keep in mind that all AVMs are considered “arms length” by nature, so in the process of underwriting approval, the appraisal process remains a vital component. The importance of an independent appraisal is clear to protecting the mortgage investor’s and consumer’s interests, and the need for a credible valuation of real property depends on “on the ground” knowledge and data provided by appraisers. To assist REALTORS® working in the appraisal industry, RPR is currently in development of the RPR Appraiser Tools Sets, guided by a task force drawn from NAR’s Real Property Valuation Committee. Once completed, the RPR Appraiser Tool Sets will provide REALTOR® appraisers with additional tools and features that leverage the strength of the RPR database. By working with appraisers, RPR can help position REALTOR® members to bring this value to both their clients and customers, and to the overall transaction process.

RPR also contributes to an improved BPO process through its partnership with NAR on the Broker Price Opinion Resource Certification (BPOR). By providing tools for the REALTOR® to analyze properties for condition, RPR can assist the mortgage investor in ways no other model has provided before.