CoreLogic released their projections on Shadow Inventory for 2013 which indicate good news for all in the housing industry. The new numbers show a 12.3% drop from October 2011.

CoreLogic released their projections on Shadow Inventory for 2013 which indicate good news for all in the housing industry. The new numbers show a 12.3% drop from October 2011.

Shadow Inventory Seen as Manageable in 2013

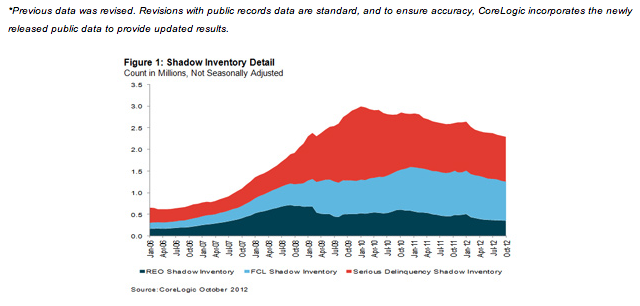

Current residential shadow inventory as of October 2012 fell to 2.3 million units*, representing a supply of seven months. The October inventory level represents a 12.3 percent drop from October 2011, when shadow inventory stood at 2.6 million units.

Click here to download the full Shadow Inventory report.

Data Highlights

- As of October 2012, shadow inventory fell to 2.3 million units, or seven months’ supply, and represented 85 percent of the 2.7 million properties currently seriously delinquent, in foreclosure or in REO.

- Of the 2.3 million properties currently in the shadow inventory (Figures 1 and 2), 1.04 million units are seriously delinquent (3.3 months’ supply), 903,000 are in some stage of foreclosure (2.8 months’ supply) and 354,000 are already in REO (1.1 months’ supply).

- As of October 2012, the dollar volume of shadow inventory was $376 billion, down from $399 billion a year ago.

- Over the three months ending in October 2012, serious delinquencies, which are the main driver of the shadow inventory, declined the most in Arizona (13.3 percent), California (9.7 percent), Michigan (6.8 percent), Colorado (6.8 percent) and Wyoming (5.9 percent).

- As of October 2012, Florida, California, Illinois, New York and New Jersey make up 45 percent of the 2.7 million properties that are seriously delinquent, in foreclosure or in REO. In October 2011, these same states made up 51.3 percent of all the distressed mortgages that were at least 90 days delinquent, in foreclosure or REO.

“The size of the shadow inventory continues to shrink from peak levels in terms of numbers of units and the dollars they represent,” said Anand Nallathambi, president and CEO of CoreLogic. “We expect a gradual and progressive contraction in the shadow inventory in 2013 as investors continue to snap up foreclosed and REO properties and the broader recovery in housing market fundamentals takes hold.”

“Almost half of the properties in the shadow are delinquent and not yet foreclosed,” said Mark Fleming, chief economist for CoreLogic. “Given the long foreclosure timelines in many states, the current shadow inventory stock represents little immediate threat to a significant swing in housing market supply. Investor demand will help to absorb the already foreclosed and REO properties in the shadow inventory in 2013.”

Click here to download the full Shadow Inventory report.

More Information

For more information, please contact your CoreLogic sales executive, send us an email, or call

(866) 774-3282 and mention Campaign Code 2011 03NSS-P001-SHADW_INVENTRY.