The National Associaton of REALTORS® and companies like Down Payment Resource have been sending information to real estate brokers for years now about the impact of QM and QRM in real estate. These new regulations are about to hit in January and they are are going to hurt. In all seriousness, I do not think that brokers or agents are prepared. The lending restrictions are going to impact the number of buyers who will qualify to purchase a home, significantly truncating demand. Moreover, the requirement that banks keep more loans in-house will restrict lending capital to fund loans.

The National Associaton of REALTORS® and companies like Down Payment Resource have been sending information to real estate brokers for years now about the impact of QM and QRM in real estate. These new regulations are about to hit in January and they are are going to hurt. In all seriousness, I do not think that brokers or agents are prepared. The lending restrictions are going to impact the number of buyers who will qualify to purchase a home, significantly truncating demand. Moreover, the requirement that banks keep more loans in-house will restrict lending capital to fund loans.

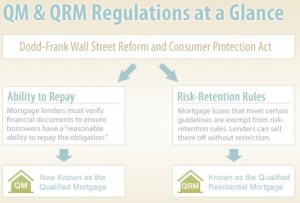

QM – Qualified Mortgage. This federal regulation requires that the bar is raised to ensure a homebuyer’s ability to repay a loan.

QRM – Qualified Residential Mortgage. This federal regulation addresses risk retention, requiring lenders to keep a certain percentage of mortgages on their books. Only loans meeting the QRM definition will be able to be sold in the secondary mortgage.

The Impact: The Consumer Financial Protection Bureau estimated that 25% of home buyers in 2011 would not have qualified for mortgage financing.

What can you do about it?

The federal government has put backstops in place to help people. There are abundant programs, some of which apply to the property and some of which apply to the buyer. The challenge is finding the right program that meets the needs of your buyer and the home they are purchasing. It is a complex matchmaking game.

Edina Realty along with a number of leading MLSs have adopted Down Payment Resource as a service. They match properties and consumers with federal and state programs. They inspired this post. Here is what they released today. It is worth a read