Zillow is finally beginning to see explosive growth in their Zillow Home Loans business. When you look at listings on Zillow.com, they are prevalently advertising their mortgage services. In the early days of mortgage advertising at Zillow, they focused on generating leads for mortgage brokers, which is the same playbook they used when they entered the property advertising market. Now, Zillow is a lender and they are growing at a remarkable rate. It’s not clear if they are taking market share from mortgage banks like Quicken Loans, Wells Fargo, cohorts or real-estate-brokerage-owned affiliated lenders. Either way: Zillow is on the move with impressive growth and they are taking business from established lenders.

Zillow has transformed their mortgage strategy by becoming a national lender though Zillow Home Loans. According to the National Mortgage News, loan originations were down 9% last quarter across the United States. In contrast, Zillow Home Loans purchase volume was up 125% year over year. Zillow announced that the mortgage opportunity is now “wide open and large.” For the second quarter of 2024, Zillow reported $759 million in mortgage transaction volume vs $340 million in the prior year. According to National Mortgage News, “Mortgage unit revenue, which includes Zillow’s marketplace business, was $34 million, up from $24 million one year prior. It was helped by a 23% increase in gain on sale revenue.”

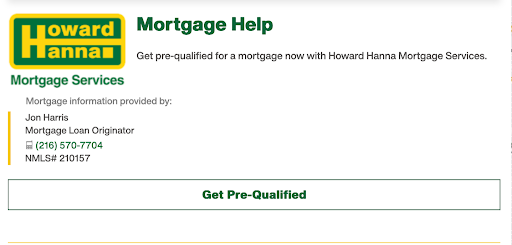

As many of you know, most of the large real estate brokerage firms have offered clients an array of additional services long before Zillow launched their Home Loans business unit. America’s largest independent real estate company, Howard Hanna has an incredibly successful mortgage business – as do many other firms who are members of The Realty Alliance and the Broker Resource Network. The same is true for firms like HomeServices of America, Redfin and many franchise organizations like RE/MAX’s offering of Motto Mortgage. Zillow has finally figured out how to tap into the mortgage opportunity – and leverage the listings of real estate brokers to drive revenue to Zillow Home Loans – as an alternative to mortgage offerings. More often now, consumers are shopping for loans at the same time as homes.

Gee… “homes and loans” does sound pretty catchy.

WAV Group has long advocated for the listing broker to negotiate terms with listing portals to compel leads on the company listings to go to the company’s agents – a term referred to as “your listing, your lead.” Additionally, WAV Group has encouraged brokers to advertise their affiliated services in mortgage and insurance on company listings. Our position is that brokers should always market their affiliated services on their listings, and never allow competitors to advertise there. Brokers would never allow a competitive broker or lender to advertise on the yard sign – why would you allow it on the digital for sale sign?

As part of this strategic playbook to boost revenue for affiliated services, we suggest that brokers who offer services in mortgage and insurance to make consumers aware of those services on their property search websites. HowardHanna.com does an excellent job of this, as does Redfin. Here is a mortgage lead capture example that is displayed on an active listing on HowardHanna.com.

In today’s competitive marketplace, brokers need to deploy an array of services to consumers. Many enterprise brokerages have residential, commercial, property management, new home, investor, mortgage, insurance, and title businesses. Florida based Watson Realty goes even further with services for plumbing, electrical, and more. Every broker’s strategic plan should be focused on all the services that consumers would want to support property ownership. Over time, pick one thing to invest in – and build that business to profitability. Partner if you need to, or use M&A strategy to expand. Then build the next business.